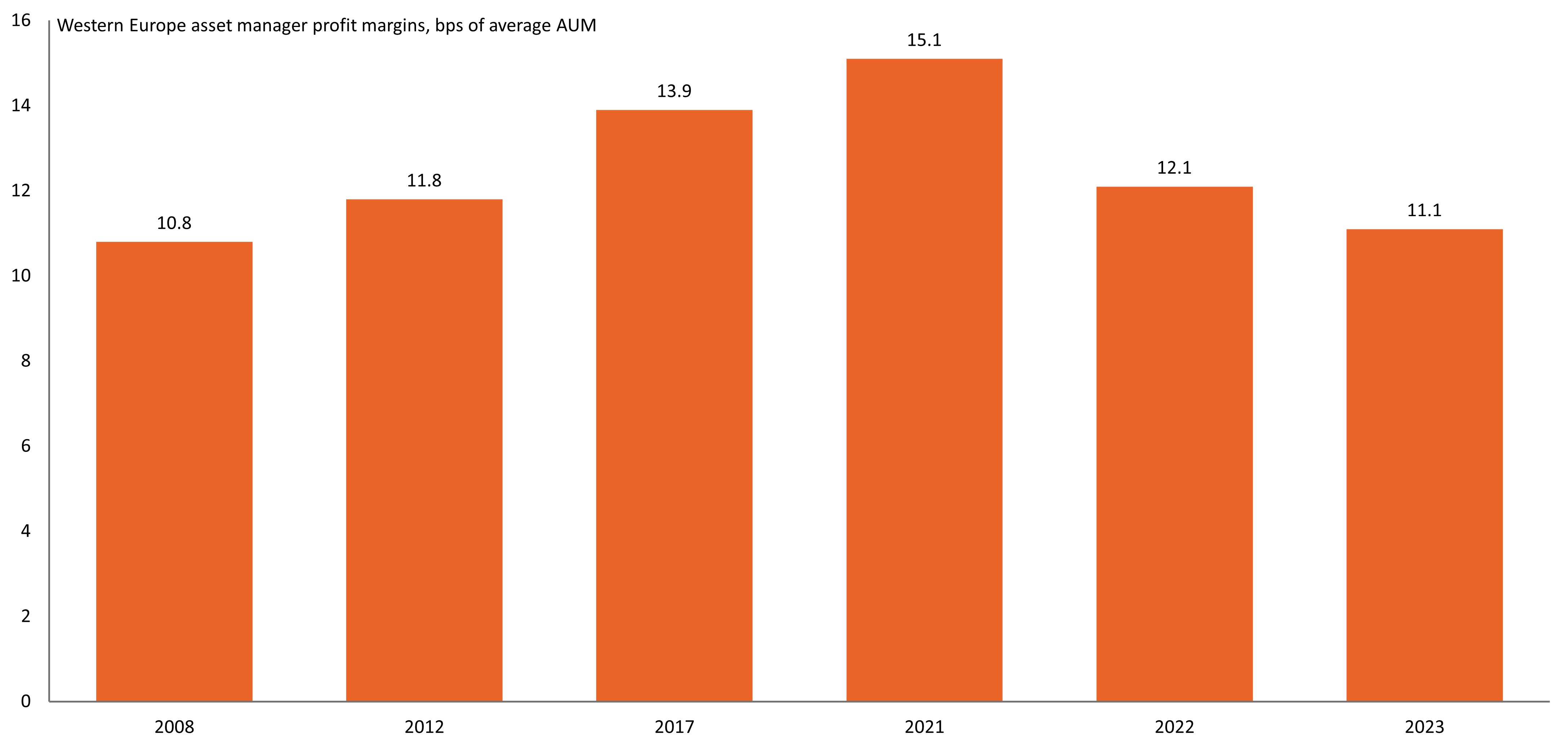

Asset manager profit margins in Western Europe slid to their lowest level since the Global Financial Crisis (GFC), according to the European Fund and Asset Management Association (EFAMA).

In its 2024 Asset Management in Europe report, the organisation found that 2023 operating profit margins fell to just 11.1bps of average AUM – down from 15.1bps in 2021.

Chart 1: Western Europe asset manager profit margins, 2008-present

Source: EFAMA, McKinsey performance lens global asset management survey

According to the report, the margin compression was “a consequence of sustained pressure on both fees and costs”.

On the fee side, the rise of passive investing and greater fee transparency has exerted significant downward pressure on industry-wide fee levels, with EFAMA expecting this trend to continue in the coming years.

Meanwhile on the cost side, managers were forced into “ever-increasing investments in new hardware, software, and data in order to remain competitive.”

A recent study from German strategy advisor zeb Consulting produced similar findings.

EFAMA’s report also found that the retail share of Europe's assets under management rose to 30.8% in 2023, up from 26% in 2019, with ETFs emerging as the group's preferred investment vehicle.