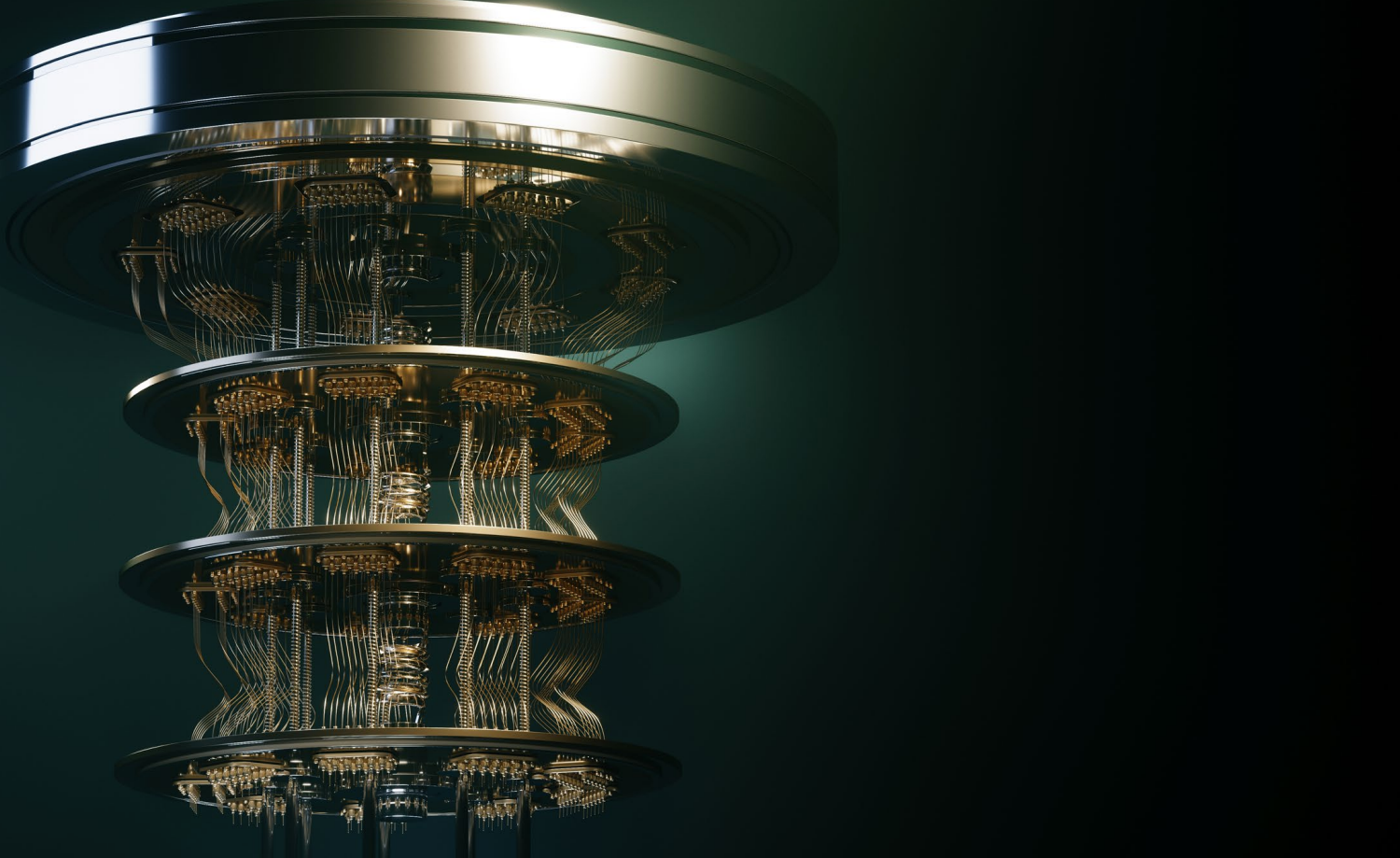

An exchange-traded product (ETP) providing triple leveraged exposure to quantum computing company IonQ was forced to close days before a potential 100% one day windfall for investors.

On 8 January, the IonQ share price fell sharply following comments from Nvidia CEO that practical quantum computing could be 20 years away.

According to a shareholder notice, an intraday rebalance in the Leverage Shares 3x Long IONQ ETP (IONQ) was triggered when IonQ's share price drop breached the 16.7% threshold set out in the methodology for the underlying Solactive 3x Long IONQ Index.

However, because IonQ's plunge exceeded 33.3% before the rebalance was concluded the ETP security value fell to zero prompting a mandatory redemption at $0.0. Investors in the ETP were effectively wiped out.

According to the provider’s website, the ETP housed assets under management of $25m making it one of the firm’s largest products.

To add insult to injury, on 15 January IonQ’s shares rallied 33.5% after Nvidia announced its first ever Quantum Day at GPU Tech Conference 2025. Triple leveraged investors therefore missed out on a potential 100% one day windfall.

Leverage Shares did not immediately respond for comment.