Retail asset management is a ‘winners take all’ market, according to management consulting firm McKinsey & Company.

In its Attention to retail: Why winners take all in retail asset management report published by the European Fund and Asset Management Association (EFAMA), the firm found that “the top flow-generating managers do not marginally outclass the competition, they dominate the field.”

This dynamic is particularly powerful in Europe, where the rise of passives and alternatives favours the biggest players.

According to McKinsey’s analysis, “relative flows correlate with investment performance but are not proportional to it – instead, the winners take all”.

This suggests that ‘sales excellence’ can make the decisive difference for managers.

The findings

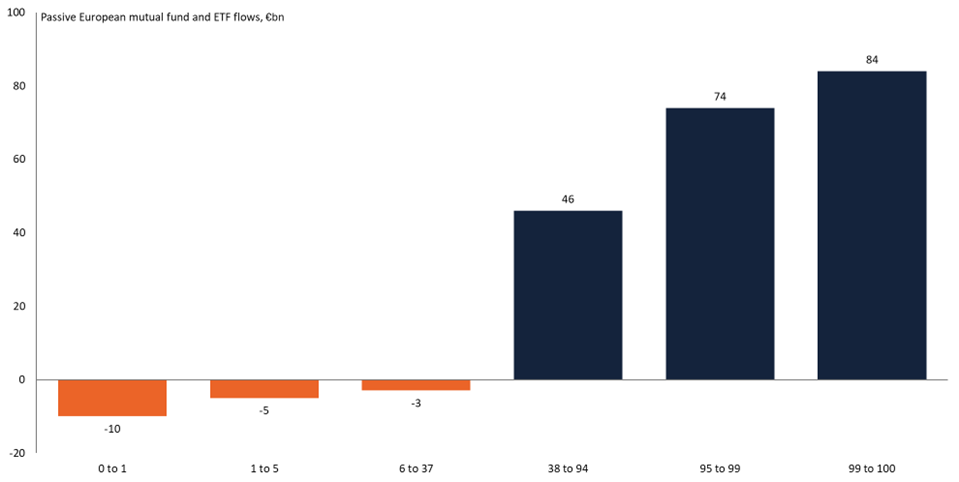

As the below chart illustrates, the top 1% of flow-generating passive managers commanded 41% of industry-wide inflows while the top 5% accounted for almost 80%. The bottom 1%, on the other hand, were responsible for 56% of total outflows.

Chart 1: Distribution of net passive flows by percentile, Jan to Aug 2024

Source: McKinsey & Company, EFAMA.

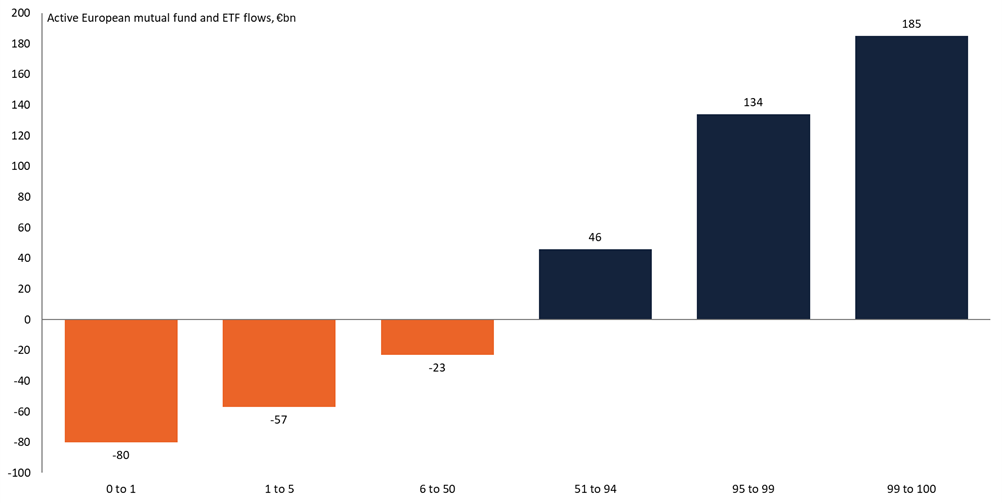

The dynamic was even more pronounced among active managers where greater performance dispersion exists across funds. In that category, over half of industry-wide inflows went to the top 1% of funds.

Chart 2: Distribution of net active flows by percentile, Jan to Aug 2024

Source: McKinsey & Company, EFAMA.

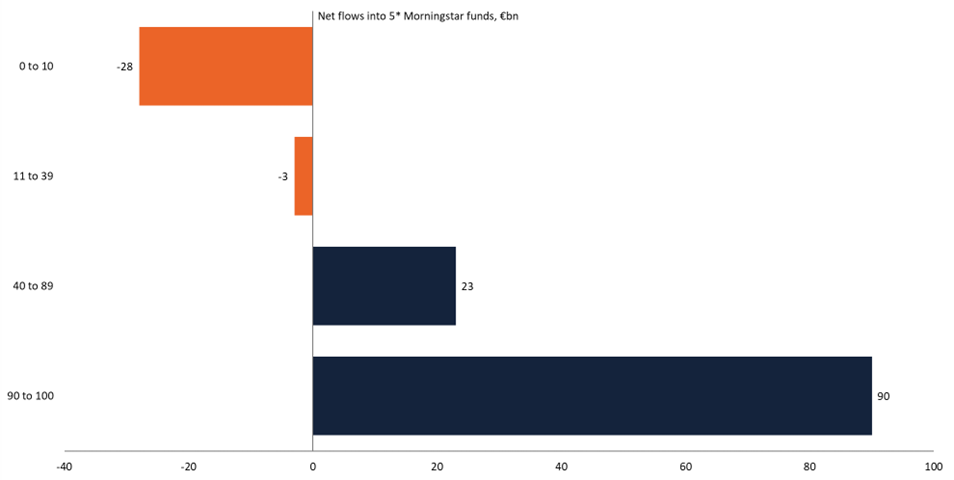

The flows were also top-heavy among funds rated five-star by Morningstar, with the top decile capturing more than 100% of net flows across the category. This suggests that factors other than investment performance were important for driving flows.

Chart 3: Distribution of net flows into 5* Morningstar funds by percentile, Jan to Aug 2024

Source: McKinsey & Company, Morningstar Direct, EFAMA.

Sales excellence

McKinsey’s analysis found that managers with ‘sales excellence’ demonstrated superior ability to gather assets – even in the face of product-related headwinds.

In other words, managers with an effective sales force and marketing strategy can outperform the competition despite selling products that run counter to market trends or have poor relative investment performance.

Conversely, managers with an ineffective sales team and distribution strategy can underperform peers despite products exposed to favourable segments of the market with strong relative investment performance.

Sales excellence tends to be ‘sticky’ over time, too. The flow-winning managers typically persist year-on-year suggesting they boast a superior overall distribution strategy versus peers.

McKinsey conducted interviews with top performers and found that they were typically one of three archetypes: ‘at-scale product providers’, ‘investment alpha-seekers’, or ‘captive AMs’. The latter are able to leverage preferential access to a distribution network.

Final word

While specific firm names were not disclosed in the report, it is likely that Europe’s ETF industry has a handful of ‘at-scale product providers’, with BlackRock, DWS and State Street Global Advisors all attracting inflows exceeding €4bn in November, according to data from LSEG Lipper.

A possible ‘captive AM’ example is Fideuram, with its D-X platform enjoying large inflows in recent months thanks to the vast distribution network associated with Intesa Sanpaolo – Italy’s largest banking group.

An ‘investment alpha-seeker’ is arguably yet to command significant ETF flows in Europe – at least on the back of exceptional investment performance. The race to be first is well and truly ramping up, however.