Diversification and downside protection strategies have served as key tools for investors in 2024 and are poised to remain valuable as market volatility persists.

The re-election of Donald Trump sparked questions surrounding how changes in economic, fiscal and immigration laws will impact inflation.

Against this uncertain backdrop, dividend ETFs offer key defensive qualities and outperformance potential during periods of heightened volatility. Similarly, convertible bond ETFs can blend equity upside with downside protection.

Antoine Lesné, head of ETF research and strategy for EMEA at State Street outlines how the firm’s ETF offering is neatly placed in the current backdrop by offering a suite of dividend ETFs alongside convertible bond ETFs.

How are investors baking economic and inflation expectations into their asset allocation?

While the disinflation trend continues as the lagged effect of the past two years of monetary tightening are gradually appearing, the last mile towards most developed central banks targets may prove a little more challenging.

A still relatively robust US economy and the re-election of Donald Trump, have left investors pondering the potential consequences of the economic, fiscal and immigration laws on inflation.

From taxing imports – 10-20% from most ‘partners’ up to 60% for some Chinese goods – to deportation of illegal migrants and its potential – at minimum momentarily - impact on supply chains, inflation pressures may rise again.

While markets have been waiting to see the actual actions and inflation expectations remaining anchored, they were quick to price out 50 basis points (bps) of rate cuts in 2025.

The softening of the still robust US economy and its labour market may continue to provide a tailwind for US small and mid-caps, which have become increasingly yield sensitive as inflation, not recession, is the number one worry for the US equity market.

We have long argued there is a solid strategic case for a broadening of market performance. The case for small and mid-caps has strengthened in November, following a decisive Republican win in the US election and a softening Federal Reserve interest rate cut.

While inflation may not fall as quickly as expected, we still expect a lower rate environment which should help this market segment, where valuation remain less expensive than their large cap peers. Another notable exposure that stands to benefit from this overall soft landing – or no landing – environment is financials, which saw its largest weekly flow since Trump 1.0 in 2016.

Investors also continue to favour equities over fixed income, with ETF flows since the election showing a 90/10% split. Within equities US dominated the flow – at 60%+ – followed by global exposures. Emerging markets and European stocks remain less attractive all the more as the threat of tariffs and geo-political risks weigh on investors’ sentiment.

How can dividend ETFs be used as a bond proxy in volatile markets?

Solid economic data in the US is continuing to suggest a soft landing is in sight. Valuations are attractive in the underweight styles and sectors. While small caps remaining compelling, dividends offer a similar diversification profile with a more defensive tilt for anticipating higher volatility.

Dividend Aristocrats offer an opportunity to play the diversification story, while also introducing a defensive tilt which has historically outperformed in higher volatility regimes.

While the yield of US equities is much lower than that of treasury bonds, the Fed has embarked on a gradual reduction of interest rate and dividend aristocrat exposures.

The latter focus on companies whose dividend has been stable or increasing over the past 20 years for example. These have historically exhibited lower drawdown in down markets when volatility increases either brutally – such as in August 2024 – or more permanently.

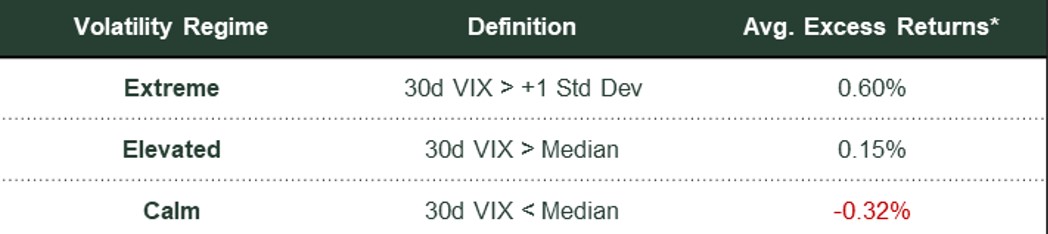

When volatility, as expressed by the VIX index, is above one standard deviation – around 27 versus a VIX long term average of 18 – the average relative outperformance has been approximately 0.60% (see table below).

Source: Bloomberg Finance L.P., as of 30 September 2024. Index performance based on net total return in USD.

Past performance is not a reliable indicator of future performance. It is not possible to invest directly into an index. Index returns are unmanaged and do not reflect the deduction of any fees or expenses. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income as applicable. *Active return of the S&P High Yield Dividend Aristocrats Index based on 30-day trailing performance, using the S&P Composite 1500 as the benchmark.

What role might convertible bond ETFs when playing defence?

The hybrid nature of convertible bonds is the root of their potential source of diversification.

Unlike holding a mix of standard bonds and equities, the advantage of the option to convert into equity means investors can benefit on both side of the exposure: track equity prices higher when they rally but be protected on the downside thanks to the bond component.

The higher convexity provides a floor limiting downside risk should the bond issuer credit remain solid.

The growth bias coupled with a ca 50% exposure to small and mid-cap companies is an interesting way to play the current market broadening.

With the global convertible universe average weighted deltas is just below 50, it provides a good opportunity to benefit from a further equity rally while providing a lower drawdown should markets reprice growth expectation down or long-term bond yield rise again.