European thematic ETFs have endured their first year of net outflows in a decade amid mixed fortunes for tech subsectors and increased financing costs for alternative energy projects.

According to Morningstar Direct's Q4 European ETF & ETC Asset Flows report, investors pulled €1.1bn from thematic products in 2024 despite European exchange-traded products (ETPs) booking a total of €247bn in net new assets - a new annual record.

The 2024 outflows from thematic ETFs are a far cry from the post-COVID boom. They attracted net inflows of €21bn between 2020 and 2021.

Morningstar noted outflows were largely driven by technology and physical world - including clean energy - ETFs, with both categories among the key beneficiaries of the product class's post-pandemic expansion.

Chart 1: Net thematic ETF flows by category, 2015-present

Source: Morningstar Direct

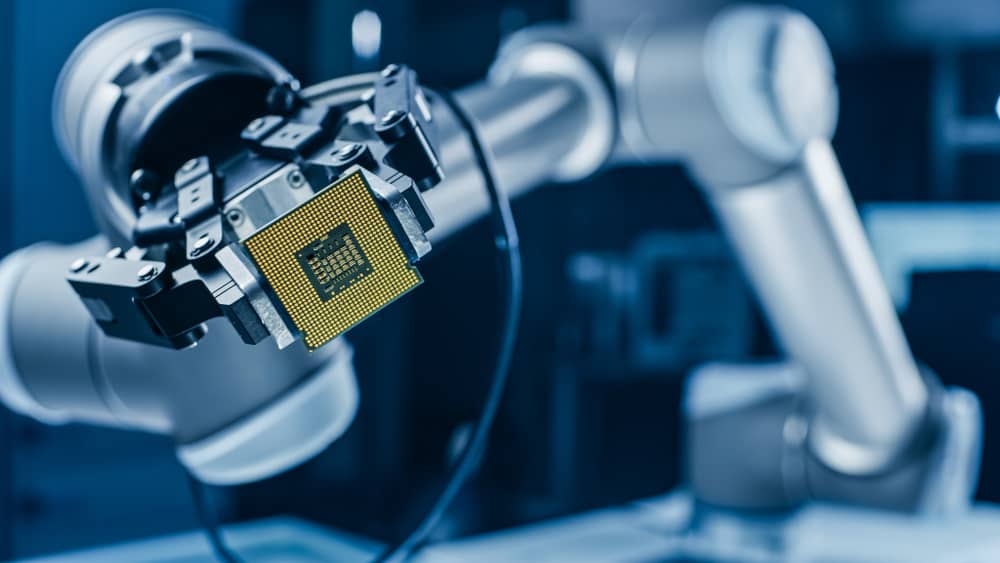

Within the technology category, continued inflows into artificial intelligence (AI) and big data ETFs in 2024 were unable to offset the losses from cybersecurity and robotics and automation funds.

Meanwhile energy transition ETFs – which attracted €6bn over the 2020-21 boom, by far the period’s biggest winner – shed €1.2bn over the year driving net outflows from the physical world classification.

Defence ETFs, on the other hand, enjoyed strong demand thanks to increasing spending commitments on national security. €1.7bn poured into these products during the year.

‘Unique challenges’ for thematic ETFs?

Last week, ETF Stream revealed that Fidelity is to close its five-strong thematic ETF range with head of ETFs Alistair Baillie Strong citing “unique challenges” for the space.

Although thematic funds remain “valuable instruments” in investor toolkits, explained Bailie Strong, the number of launches has continued to grow despite a worsening flow picture.

For Kenneth Lamont, principal at Morningstar, the closures are not surprising.

“Thematic funds have been not immune but certainly less susceptible to the fee pressures we've seen elsewhere – a compelling a reason for asset managers to develop products and launch them.

“We’ve seen huge expansion, but not all products are going to be winners.”

In terms of the recent outflows, Raymond Backreedy, chief investment officer at Sparrows Capital, views them as largely “noise” – most likely “profit-taking from profitable themes such as AI, software and data centres”.

For Lamont, too, the outflows are not the beginning of the end for thematic ETFs.

“Thematic funds overwhelmingly exhibit a growth bias. With such a small number of stocks driving such a large portion of the market’s returns, it’s not surprising that thematic products have gone through a period of underperformance after a huge post-covid boom.”